“Four Facts about International Central Bank Communication”

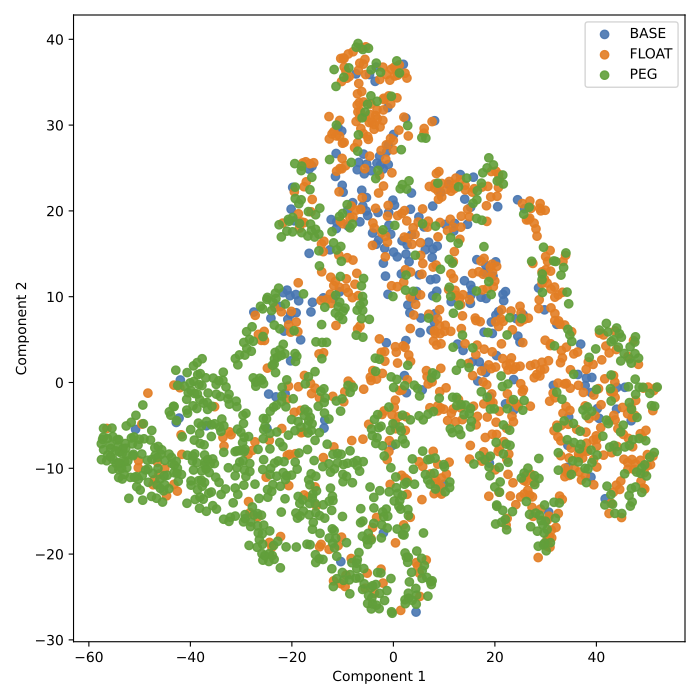

- Abstract: This paper introduces a novel database of text features extracted from the speeches of 53 central banks from 1996 to 2023 using state-of-the-art NLP methods. We establish four facts: (1) central banks with floating and pegged exchange rates communicate differently, and these differences are particularly pronounced in discussions about exchange rates and the dollar, (2) communication spillovers from the Federal Reserve are prominent in exchange rate and dollar-related topics for dollar peggers and in hawkish sentiment for others, (3) central banks engage in FX intervention guidance, and (4) more transparent institutions are less responsive to political pressure in their communication. (C55, E42, E5, F31, F42)

- Keywords: Exchange Rates, Natural Language Processing (NLP), International Spillovers, Monetary Policy.