“Central Bank Mandates and Monetary Policy Stances: through the Lens of Federal Reserve Speeches” with Isaiah Hull, Robin Lumsdaine, and Xin Zhang, Journal of Econometrics, forthcoming.

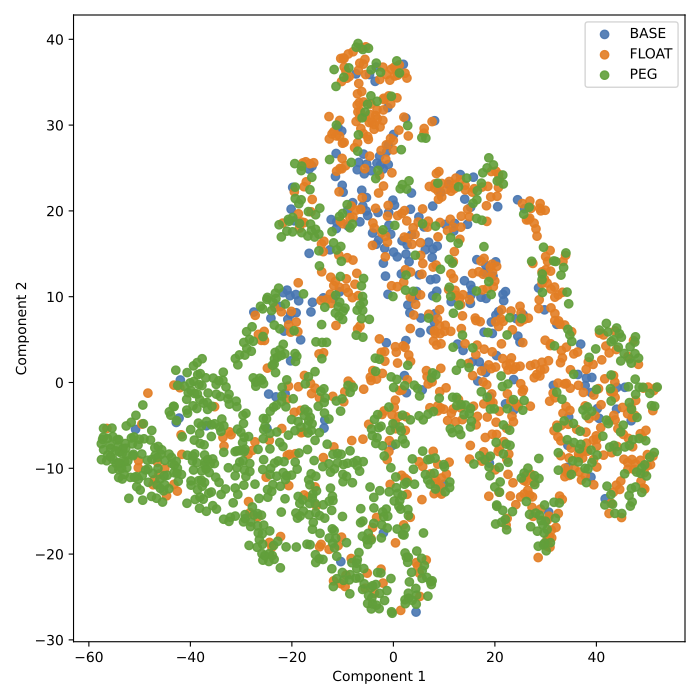

- Abstract: The Federal Reserve System has an institutional mandate to pursue price stability and maximum sustainable employment; however, it remains unclear whether it can also pursue secondary objectives. The academic literature has largely argued that it should not. We characterize the Fed’s interpretation of its mandate using state-of-the-art methods from natural language processing, including a collection of large language models (LLMs) that we modify for enhanced performance on central bank texts. We apply these methods and models to a comprehensive corpus of Fed speeches delivered between 1960 and 2022. We find that the Fed perceives financial stability to be the most important policy concern that is not directly enumerated in its mandate, especially in times when the debt-to-GDP ratio is high, but does not generally treat it as a separate policy objective. In its policy discourse, it has frequently discussed the use of monetary policy to achieve financial stability, which we demonstrate generates movements in asset prices, even after rigorously controlling for macroeconomic and financial variables. (C55, E42, E5, E61, G28)

Keywords: Large Language Models, Machine Learning, Central Bank Communication, Financial Stability. An earlier version is available as Riksbank Working Paper No. 417