REFEREED PUBLICATIONS

“Central Bank Mandates and Monetary Policy Stances: through the Lens of Federal Reserve Speeches” with Isaiah Hull, Robin Lumsdaine, and Xin Zhang, Journal of Econometrics, Volume 249, Part C, May 2025.

- Abstract: The Federal Reserve System has an institutional mandate to pursue price stability and maximum sustainable employment; however, it remains unclear whether it can also pursue secondary objectives. The academic literature has largely argued that it should not. We characterize the Fed’s interpretation of its mandate using state-of-the-art methods from natural language processing, including a collection of large language models (LLMs) that we modify for enhanced performance on central bank texts. We apply these methods and models to a comprehensive corpus of Fed speeches delivered between 1960 and 2022. We find that the Fed perceives financial stability to be the most important policy concern that is not directly enumerated in its mandate, especially in times when the debt-to-GDP ratio is high, but does not generally treat it as a separate policy objective. In its policy discourse, it has frequently discussed the use of monetary policy to achieve financial stability, which we demonstrate generates movements in asset prices, even after rigorously controlling for macroeconomic and financial variables. (C55, E42, E5, E61, G28)

- Keywords: Large Language Models, Machine Learning, Central Bank Communication, Financial Stability.

- An earlier version is available as Riksbank Working Paper No. 417.

“A Wake-Up Call Theory or Contagion” with Toni Ahnert, Review of Finance, Volume 26, Issue 4, Pages 829–854, July 2022.

- Abstract: We offer a theory of financial contagion based on the information choice of investors after observing a financial crisis elsewhere. We study global coordination games of regime change in two regions linked by an initially unobserved macro shock. A crisis in region 1 is a wake-up call to investors in region 2. It induces them to reassess the regional fundamental and acquire information about the macro shock. Contagion can occur even after investors learn that region 2 has no ex-post exposure to region 1. We explore normative and testable implications of the model. In particular, our results rationalize evidence about contagious currency crises and bank runs after wake-up calls and provide some guidance for future empirical work. (D83, F3, G01, G21)

The value of information v and the proportion of informed investors n2 with and without a wake-up call, f ∈ {1, 0}. The figure shows (1) the strategic complementarity in information choices and (2) the intermediate range of information costs for which we establish information acquisition only after a wake-up call.

- Keywords: wake-up call, information choice, financial crises, contagion, bank run, global games, regime change, fundamental re-assessment.

- An earlier version is available as ECB Working Paper No. 2658.

“Monetary Normalizations and Consumer Credit: Evidence from Fed Liftoff and Online Lending” with Isaiah Hull and Xin Zhang, International Journal of Central Banking, Volume 18, Number 5, Pages 279–325, December 2021.

- Abstract: On December 16th of 2015, the Fed initiated “liftoff,” a critical step in the monetary normalization process. We use a unique panel dataset of 640,000 loan-hour observations to measure the cross-sectional impact of liftoff on interest rates, demand, and supply in the peer-to-peer market for uncollateralized consumer credit. We find that the spread decreased by 17%, driven by an increase in supply. Our results are consistent with an investor-perceived reduction in default probabilities; and suggest that liftoff provided a strong, positive signal about the future solvency of high credit risk borrowers. (JEL D14, E43, E52, G21)

The figure plots the time trend in the interest rate after controlling for loan and borrower composition. We recover the trend by performing a regression of the interest rate on all loan-borrower controls and computing the means of the residuals for all loans posted in the same hour. Finally, we plot the three-cohort rolling mean of the cohort-specific means over a ±14-day window around liftoff.

- Keywords: monetary policy signaling, consumer loans, credit risk, FinTech.

- An earlier version is available as Sveriges Riksbank Working Paper No. 319.

“Narrative Fragmentation and the Business Cycle” with Isaiah Hull and Xin Zhang, Economics Letters, Volume 201, April 2021.

- Abstract: According to Shiller (2017), economic and financial narratives often emerge as a con- sequence of their virality, rather than their veracity, and constitute an important, but understudied driver of aggregate fluctuations. Using a unique dataset of news- paper articles over the 1950-2019 period and state-of-the-art methods from natural language processing, we characterize the properties of business cycle narratives. Our main finding is that narratives tend to consolidate around a dominant explanation during expansions and fragment into competing explanations during contractions. We also show that the existence of past reference events is strongly associated with increased narrative consolidation. (C63, D84, E32, E7)

The figure above shows the rolling mean of detrended GDP growth plotted against detrended, within-topic entropy, averaged over all topics for the sample period 1965-2019.

- Keywords: Natural Language Processing, Machine Learning, Narrative Economics.

- An earlier version is available as Sveriges Riksbank Working Paper No. 401.

“Bank Misconduct and Online Lending” with Isaiah Hull, Yingjie Qi and Xin Zhang, Journal of Banking & Finance, Volume 116, July 2020.

- Abstract: We introduce a high quality proxy for bank misconduct that is constructed from Consumer Financial Protection Bureau (CFPB) complaint data. We employ this proxy to measure the impact of bank misconduct on the expansion of online lending in the United States. Using nearly complete loan and application data from the online lending market, we demonstrate that bank misconduct is associated with a statistically and economically significant increase in online lending demand at the state and county levels. This result is robust to the inclusion of bank credit supply shocks and holds for both broader and more narrowly-defined bank misconduct measures. Furthermore, we show that this effect is strongest for lower rated borrowers and weakest in states with high levels of generalized trust. (JEL A13, G00, G21, K00)

The figure shows the estimated difference in the P2P’s share of total debt between treated and control counties. The horizontal axis shows the number of months that have elapsed since a major banking scandal occurred in the treatment counties. The vertical axis shows the difference in the P2P’s share of total debt. We identify the date of bank scandals through the use of newspaper articles drawn from Factiva and CFPB enforcement actions. These events are also associated with sharp increases in the number of reported CFPB complaints.

- Keywords: financial development, consumer loans, bank misconduct, FinTech.

- An earlier version is available under the title “The Role of Trust in Online Lending” as Sveriges Riksbank Working Paper No. 346.

“Spread the Word: International Spillovers from Central Bank Communication” with Hanna Armelius, Isaiah Hull and Xin Zhang, Journal of International Money and Finance, Volume 103, Pages 1-32, May 2020. – Lead article –

- Abstract: We construct a novel text dataset to measure the sentiment component of communications for 23 central banks over the 2002-2017 period. Our analysis yields three results. First, comovement in sentiment across central banks is not reducible to trade or financial flow exposures. Second, sentiment shocks generate cross-country spillovers in sentiment, policy rates, and macroeconomic variables; and the Fed appears to be a uniquely influential generator of such spillovers, even among prominent central banks. And third, geographic distance is a robust and economically significant determinant of comovement in central bank sentiment, while shared language and colonial ties have weaker predictive power. (JEL E52, E58, F42)

The figure shows the normalized rolling net sentiment scores associated with ECB speeches. Sentiment scores are computed using a dictionary-based approach documented in Loughran and McDonald (2011).

- Keywords: communication, monetary policy, international policy transmission.

- An earlier version is available as BIS Working Paper No. 824.

“Systematic bailout guarantees and tacit coordination” with Claudio Calcagno and Mark Le Quement, The B.E. Journal of Economic Analysis & Policy (Advances), Volume 15, Issue 1, Pages 1-36, December 2014. – Lead article –

- Abstract: Both the academic literature and the policy debate on systematic bailout guarantees and Government subsidies have ignored an important effect: in industries where firms may go out of business due to idiosyncratic shocks, Governments may increase the likelihood of (tacit) coordination if they set up schemes that rescue failing firms. In a repeated-game setting, we show that a systematic bailout regime increases the expected profits from coordination and simultaneously raises the probability that competitors will remain in business and will thus be able to ’punish’ firms that deviate from coordinated behaviour. These effects make tacit coordination easier to sustain and have a detrimental impact on welfare. While the key insight holds across any industry, we study this question with an application to the banking sector, in light of the recent financial crisis and the extensive use of bailout schemes. (JEL D43, G21, K21, L41)

- Keywords: competition policy, systematic bailout guarantees, collusion, banking, State aid.

- An earlier version is available as Sveriges Riksbank Working Paper No. 289.

WORKING PAPERS

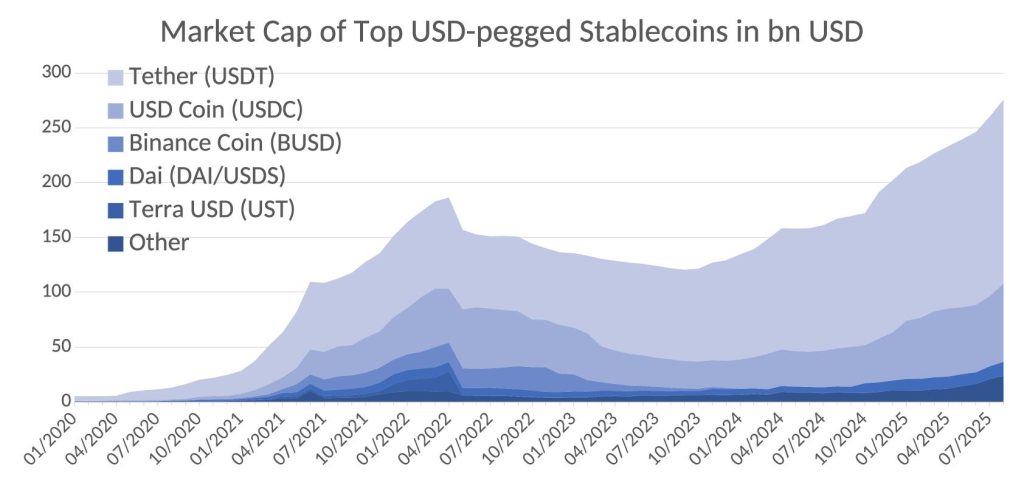

“Stablecoins: Adoption and Fragility” (Sveriges Riksbank Working Paper No. 423; This version: 12/2025)

-

This paper develops a payment-centric model of stablecoin runs with endogenous consumer adoption and seller acceptance, making the issuer’s liability composition an equilibrium outcome. Stablecoin fragility arises endogenously from shifts in the composition of the holder base as adoption expands across transactional environments. Broader adoption attracts users who derive lower transactional value from holding stablecoins, increasing the aggregate propensity to run and generating a destabilizing run externality that individual adoption decisions do not internalize. In addition, sellers’ multi-homing choices create uninternalized network effects that erode the transaction value of bank deposits. By linking adoption dynamics to issuer fragility, the model provides theoretical foundations for regulatory concerns about excessive stablecoin adoption and delivers novel testable implications. The analysis further shows that seigniorage and congestion effects can mitigate run risk, whereas issuer moral hazard can amplify fragility, even in the presence of regulatory disclosure. (D83, E4, G01, G28)

- Keywords: Money, payment preferences, financial stability, financial regulation.

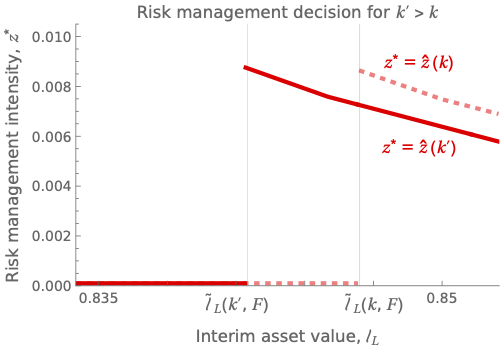

“Bank Fragility and Risk Management” with Toni Ahnert, Agnese Leonello, and Robert Marquez (Sveriges Riksbank Working Paper No. 441; This version: 06/2025)

- Abstract: Shocks to a bank’s ability to raise liquidity at short notice can trigger depositor panics. Why don’t banks take a more active role in managing these risks? We study contingent risk management (hedging) in a standard global-games model of a bank run. Banks fail to hedge precisely when the exposure to a shock is most severe, just when risk management would have the biggest impact. Higher bank capital and broader deposit-insurance coverage crowd out hedging, yet encourage more banks to establish risk management desks in the first place. The model also yields testable implications for hedging incentives and policy design. (G01,G21,G23)

The figure shows the risk management intensity z* as a function of the interim asset value for two levels of bank capital: k and k’>k. We can see that banks fail to do any risk management when the interim asset value is low, and that risk management failures are facilitated by lower levels of bank capital.

- Keywords: Bank runs, liquidity risk, hedging, interim asset valuation.

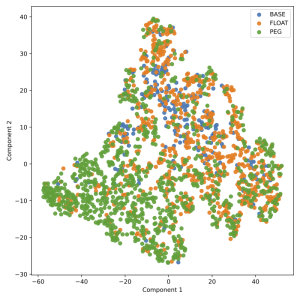

“Four Facts about International Central Bank Communication” with Isaiah Hull, Robin Lumsdaine, and Xin Zhang (Sveriges Riksbank Working Paper No. 432)

- Abstract: This paper introduces a novel database of text features extracted from the speeches of 53 central banks from 1996 to 2023 using state-of-the-art NLP methods. We establish four facts: (1) central banks with floating and pegged exchange rates communicate differently, and these differences are particularly pronounced in discussions about exchange rates and the dollar, (2) communication spillovers from the Federal Reserve are prominent in exchange rate and dollar-related topics for dollar peggers and in hawkish sentiment for others, (3) central banks engage in FX intervention guidance, and (4) more transparent institutions are less responsive to political pressure in their communication. (C55, E42, E5, F31, F42)

The figure visualizes the output of the t-stochastic nearest neighbors (t-SNE) algorithm applied to the exchange rate, U.S. dollar and international trade text features for 21 central banks. We construct three categories for the visualization: “base” currencies in blue (U.S. dollar/Federal Reserve System, Euro/ECB), floating currencies in orange, and pegged currencies in green.

- Keywords: Exchange Rates, Natural Language Processing (NLP), International Spillovers, Monetary Policy.

“Optimal Bank Leverage and Recapitalization in Crowded Markets” with Mike Mariathasan (BIS Working Paper No. 923; This version: 01/2021)

- Abstract: We study optimal bank leverage and recapitalization in general equilibrium when the supply of specialized investment capital is imperfectly elastic. Assuming incomplete insurance against capital shortfalls and segmented financial markets, ex-ante leverage is inefficiently high, leading to excessive insolvencies during systemic capital shortfall events. Recapitalizations by equity issuance are individually and socially optimal. Additional frictions can turn asset sales individually but not necessarily socially optimal. Our results hold for different bankruptcy protocols and we offer testable predictions for banks’ capital structure management. Our model provides a rationale for macroprudential capital regulation that does not require moral hazard or informational asymmetries. (D5, D6, G21, G28)

This figure depicts for a given level of leverage (horizontal axis) the market-clearing price for specialized investment capital and the threshold level of bank portfolio risk below which liability side recapitalizations (red) and asset side recapitalizations (blue) are feasible.

- Keywords: bank capital, recapitalization, macroprudential regulation, incomplete markets, financial market segmentation, constrained inefficiency.

- Builds on the older paper “Fire Sale Bank Recapitalizations”: 09/2015.

“A detrimental feedback loop: deleveraging and adverse selection”

(This version: 08/2015; First version: 09/2013)

- Abstract: Market distress can lead to a deleveraging wave, as in the 2007/08 financial crisis. This paper demonstrates how market distress and deleveraging can fuel each other in the presence of adverse selection in opaque asset markets. A detrimental feedback loop emerges: investors reduce their reliance on opaque markets by decreasing their leverage which in turn amplifies adverse selection. In the extreme, trade breaks down. Asymmetric information together with incomplete markets is at the root of two inefficiencies: investors’ leverage choices are distorted and investors’ liquidity management exhibits under-investment in cash. I discuss policy implications and the ambiguous role of transparency.

- Keywords: Endogenous borrowing constraints, financial crisis, liquidity, fire sales, opacity, private information, central bank policy.

Published as “A detrimental feedback loop: deleveraging and adverse selection”, Sveriges Riksbank Working Paper No. 277, 2013.

“A Model of Liquidity Provision with Adverse Selection”

(This version: 12/2012; First version: 12/2010)

- Abstract: This paper analyzes a model of liquidity provision where liquidity risk is shared in two distinct spot markets. One of them is a market for asset sales prone to an adverse selection problem and the other is a collateralized credit market, which is not subject to an adverse selection problem. I find that the increased availability of collateralized credit (ex-post) may make the adverse selection problem in the asset market more severe. As a result, the relationship between the completeness of markets and equilibrium welfare, as well as efficiency, is non-monotone. Furthermore, I generate a financial crisis by introducing an aggregate liquidity or solvency shock, which amplifies the adverse selection problem, leading to a market failure. A central bank can address this market failure by using existing market institutions to re-allocate liquidity in the economy. Interestingly, the central bank has to be willing and able to incur a loss.

- Keywords: liquidity, asymmetric information, open market operations.

Disclaimer: This is my private homepage and the views expressed are my own.